The Effect of Education Spending on Student Achievement

Evidence from Property Values and School Finance Rules

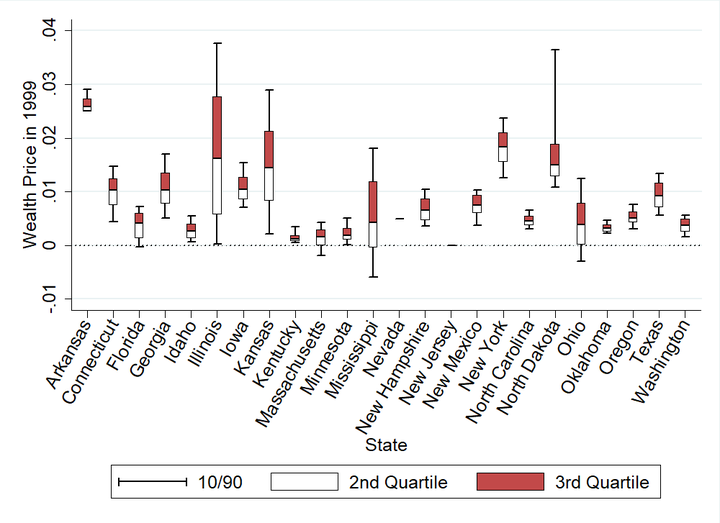

Opportunities to estimate the causal effect of school spending on student achievement are infrequent and have been based, almost entirely, on variation in spending from large school finance reforms. Property values also affect school spending through both local property tax revenue and the level of state aid provided to each school district. However, little is known about the effect property values have on student achievement through their impact on school revenue. In this paper, I estimate the effect of education spending on district-level student outcomes in 24 states by leveraging changes in revenue driven by property value variation. I interact state-level changes in property values with fixed school finance formulas that measure how state aid and local revenue respond to those changes (the “wealth price”) to create a simulated instrument for school spending. By collecting administrative data on property values for over 7,000 school districts, I am able to measure a leave-one-out mean change in property values for school districts in each state. The instrument is highly predictive of changes in revenue and spending. My estimates suggest that a 10 percent increase in spending improves graduation rates by 3 to 5 percentage points and student test scores by 0.07 to 0.09 standard deviations. These results suggest that market variation in property values affects student outcomes through existing school finance formulas.