Employer-Sponsored Health Insurance Premiums and Income in US Tax Data

Abstract

We explore how teachers unions affect education production by comparing outcomes between districts allocating new tax revenue amidst collective bargaining negotiations and districts allocating tax revenue well before. Districts facing union pressure increase teacher salaries and benefits, spend down reserves, and experience no student achievement gains. Conversely, districts facing less pressure hire more teachers (instead of increasing compensation) and realize significant student achievement gains. We interpret these results as causal evidence of the negative impact of teacher rent seeking on education production, as the timing of district tax elections relative to collective bargaining appears to be as good as random.

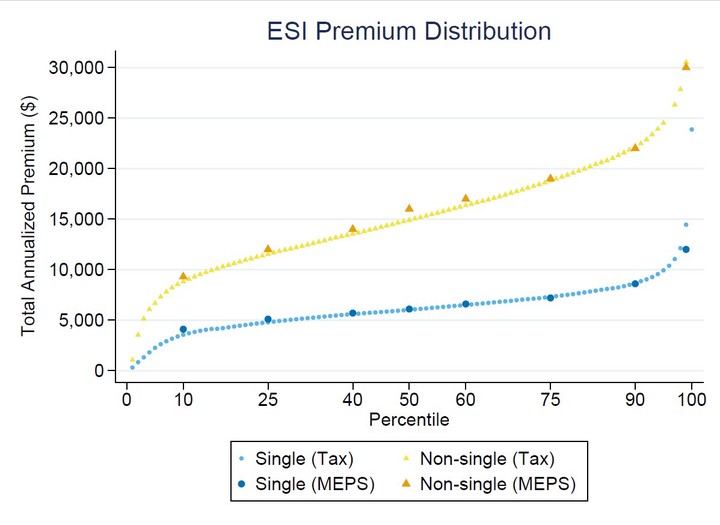

The distribution of employer-sponsored health insurance premiums in the United States is difficult to fully characterize with survey data. Using administrative tax data, we plot the population distribution of premiums and provide new evidence about the relationship between premiums and demographic characteristics, such as income. First, we demonstrate that the distribution of premiums measured in the tax data is comparable to survey data. Then we leverage detailed individual-level information for the population of tax filers to show that those with higher incomes are more likely to have an employer-sponsored insurance (ESI) policy and, conditional on having a policy, select more expensive plans. In fact, those in the top 10 percent of the income distribution account for 21 percent of aggregate ESI premiums. Even with these disparities though, inequality in ESI spending is less than half of that in income overall.